Overview of the property market in London: tips for Polish emigrants

The London property market is known for its complexity and diversity, which can cause difficulties for new residents. In this guide we will look at the main features of the market, provide advice on renting and buying a home, and discuss the legal and financial aspects that Polish emigrants should consider. If after a long day filled with house-hunting you feel like relaxing, you can take advantage of special offers and get 50 darmowych spinów bez depozytu to try your luck without investing.

Features of the London property market

London is a city with a rich history and diverse architecture, which is reflected in its housing market. There are both modern apartments and historic buildings, each with its own unique characteristics.

High cost of housing

London is consistently among the most expensive cities in the world in terms of property value. The average price of housing in the capital is significantly higher than the national figures. As of October 2022, the average property value in the UK reached £296,000, with prices in London significantly higher.

Diversity of neighbourhoods

The city is divided into many neighbourhoods, each with its own atmosphere, infrastructure and price levels. Central areas, such as Mayfair, are known for their prestige and high property prices. For example, the minimum price per square metre in Mayfair is around £19,000.

Competition in the market

The high demand for housing leads to significant competition amongst tenants and buyers. This is especially true in popular neighbourhoods where properties quickly find new owners or occupants.

Renting a home: what you need to know

For many emigrants, renting a home is the first step after moving. This process has its own peculiarities that are important to consider.

Finding a suitable option

- Online platforms: Websites such as Rightmove and Zoopla offer a wide range of rental listings.

- Estate agents : Professional agents can help you find a property to suit your requirements and budget.

- Social media and communities: Facebook groups or forums can provide information on available options from individuals.

Rental agreement

Before signing a contract, it is important to read the terms and conditions carefully:

- Term of the lease: Usually the agreement is for 6 or 12 months with an option to renew.

- Deposit: A deposit of one month's rent is usually required, which is refundable at the end of the tenancy provided the property is intact.

- Responsibilities of the parties: Check which utilities are included in the rent and which are paid separately.

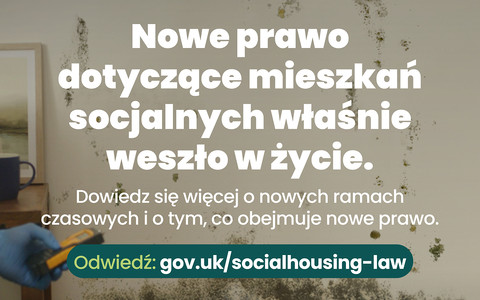

Legal aspects

- Document Check: The landlord has the right to ask for proof of your ability to pay and right to remain in the country.

- Deposit registration: In England, deposits must be registered with one of the official deposit protection schemes.

Buying a property: step by step

The decision to buy a home in London requires careful preparation and an understanding of the local market.

Rights of foreign buyers

There are no restrictions on non-residents buying property in the UK. Foreign nationals can purchase both residential and commercial property on the same terms as locals.

Stages of purchase

- Determining your budget: Consider not only the cost of the property, but also additional costs such as taxes, legal fees and possible repairs.

- Searching for a property : Use online platforms, estate agents and personal contacts to find a suitable property.

- Offer and Acceptance: Once the property has been selected, a formal offer must be made to the seller. If the parties agree, the process of formalising the transaction begins.

- Legal support: It is recommended to hire a lawyer specialising in real estate to check the documents and prepare the sale and purchase agreement.

- Finalising the transaction: Once all the documents have been signed and the funds have been transferred, you become the official owner of the property.

Financial aspects

- Stamp Duty LandTax: In the UK, buyers of property are liable to pay Stamp Duty Land Tax, which depends on the value of the property.

- Mortgages for foreigners: Some UK banks offer mortgages to non-residents, but the terms and conditions may vary. Proof of income and creditworthiness is required.

Advice on choosing a neighbourhood

Choosing a neighbourhood to live in depends on personal preference, budget and your relocation goals.

Central neighbourhoods

- Mayfair: Prestigious area with high property prices, known for its upmarket shops and restaurants.

- Kensington and Chelsea: Historic neighbourhoods with beautiful architecture and infrastructure.

Northern neighbourhoods

- Camden: Known for its bohemian atmosphere, markets and music venues.

- Islington: Popular with young professionals for its cosy cafes and proximity to the centre.

Eastern neighbourhoods

- Shoreditch: A trendy neighbourhood with lots of art galleries, bars and start-ups.

- Stratford: An area that has undergone significant redevelopment for the 2012 Olympics, with good transport accessibility.

Southern neighbourhoods

- Greenwich: A historic neighbourhood with parks and markets on the south bank of the Thames.

- Clapham: Popular with young families for its parks and schools.

Western neighbourhoods

- Hammersmith: A commercial area with good transport links.

- Notting Hill: Famous for its colourful houses, Portobello Market and annual carnival.

Legal and financial advice

It is advisable to seek professional advice before deciding whether to buy or rent a property.

Legal support

- Property lawyers - will help to check the legal cleanliness of the property, prepare and execute the necessary documents.

- Notary services - although notaries are not always required in the UK, they may be needed for some contracts.

- Estate agents - professionals who help with the search, negotiation and completion of the transaction, reducing the risk of mistakes.

Financial advice

Buying a property is a significant investment, so it is important to approach financial planning wisely.

- Tax advisors can help calculate property taxes and possible tax benefits.

- Mortgage brokers can help you find favourable loan terms, especially if you plan to use a mortgage.

- Financial analysts can provide advice on investing in London property, taking into account long-term trends.

And if you are looking for a way to relax after making important decisions, you can take advantage of the offer and get 100 darmowych spinów bez depozytu to enjoy gambling without risking your budget.

Prospects for the property market in London

The housing market in the British capital remains stable despite fluctuations in the economic situation. In recent years, there has been an increase in demand for rentals, especially among expatriates and students. This makes London an attractive investment destination.

Forecasts for the coming years

- Price growth - despite global economic changes, property values in prime areas of London continue to increase.

- Rental demand - more people are choosing to rent due to high purchase prices. This creates a good environment for investors.

- Suburban development - areas outside of central areas are becoming increasingly attractive due to better accessibility and more affordable prices.

Conclusion

The London property market offers many opportunities, but it also requires careful consideration. It is important for Polish expatriates to research the market in advance, prioritise and prepare for the financial and legal nuances.

If your goal is to rent, it is worth analysing prices in different areas and choosing convenient transport routes. For those planning to buy, it is important to consider additional costs such as taxes, agents' commission and possible repairs.

Whether you are choosing a property for your own use or for investment, market knowledge and a sensible approach can help you avoid problems and make a favourable choice. London offers a variety of property options to suit different budgets and preferences.