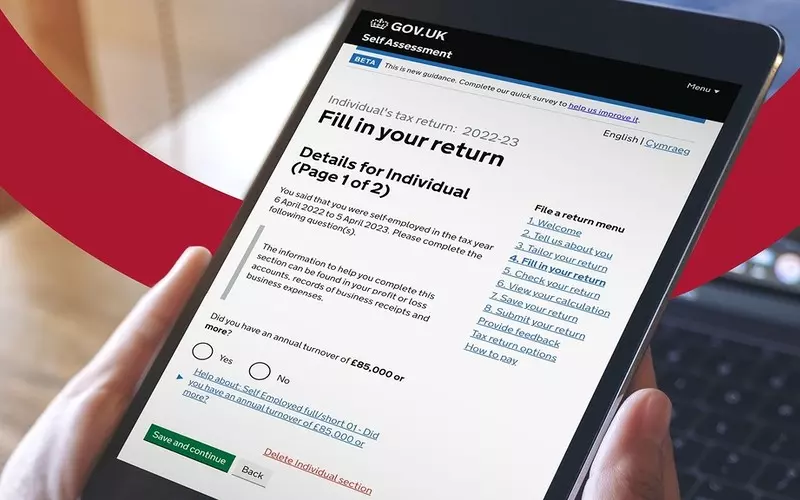

Self Assessment – are you in or out?

What is Self Assessment and why do I need to do it?

Self Assessment is the process used for you to declare and pay any tax owed on any untaxed income.

For example, if you are employed, then your employer will deduct any tax owed (Income Tax and National Insurance) before they pay you. If you earn anything that is not taxed at source, you may be required to do a Self Assessment tax return.

GOV.UK sets out who must send a Self Assessment tax return each year. If you are unsure, you can use the free online checking tool on GOV.UK to check whether it applies to you.

Self Assessment is retrospective. The reporting period starts on 6 April following the end of the tax year you need to tell HMRC about. The current Self Assessment reporting period is for the 2022 to 2023 tax year.

How can I register for Self Assessment?

Once you have found out that you need to complete Self Assessment, you must register. You can register via GOV.UK. If you are self-employed, you will need to register for Self Assessment and Class 2 National Insurance contributions.

You need to register for Self Assessment by 5 October or you could face a penalty if you don’t.

Once you have registered, HMRC will send you your Unique Taxpayer Reference (UTR). Keep this code safe because you will need it every year when you complete your Self Assessment.

I’m worried about making errors on my tax return, is there any help available?

It is important to make sure the information you provide on your tax return is accurate and HMRC wants to help taxpayers to get it right first time. There are resources and guidance to help you with your tax return on GOV.UK. HMRC has a series of video tutorials on YouTube to help you too, including how you can register and fill in your first tax return. There is also a new customised step by step guide for anyone that is filing for the first time.

What information will I need before I start my tax return?

When you are ready to start your tax return you will need your UTR and National Insurance number, as well as details of your income, earnings and other financial records. If you are unsure what records you need to keep in order to complete your Self Assessment, you can check on GOV.UK.

When is the deadline and how long will it take me?

The Self Assessment deadline for filing tax returns online is 31 January 2024. You must file your tax return and pay any tax owed by the deadline. If you miss the deadline, you may incur penalties.

Other Self Assessment dates to remember:

- 5 October – tell HMRC and register for Self Assessment (you will only need to do this once)

- 31 October – deadline for paper tax returns

- 30 December – deadline if you pay tax through PAYE and want to pay your Self Assessment bill through your tax code

The quickest and easiest way to complete your Self Assessment is online. You can save your progress and fill it in at a time that suits you ahead of the deadline. There is no fixed length of time to complete your tax return. If you have straight forward tax affairs, the likelihood is that it will take you less time to complete it compared to someone with complex tax affairs. Whatever your situation, HMRC’s resources and guidance can support you through the process.

I’ve made it, my Self Assessment is done and submitted, what now?

Once you have filed your Self Assessment, it is time to arrange to pay any tax you owe. The earlier you file, the more time you will have to plan how you will pay your tax bill. You could choose to pay via direct debit, through the HMRC app, or by setting up a budget payment plan – a full list of payment options is on GOV.UK.

Do I need to do Self Assessment every year, even if I don’t make as much money as last year?

Yes, Self Assessment happens every year. You can file your tax return for the 2022 to 2023 tax year between 6 April 2023 and 31 January 2024.

If you have previously completed a Self Assessment tax return but no longer think you need to because you have stopped being self-employed or are leaving a business partnership. It is important to tell HMRC before the deadline on 31 January 2024 to avoid any penalties.

Are there any top tips that could help me file my tax return?

Here are 5 tips that may help when filing your tax return.

- Plan ahead – when you are ready to start, get all your documents you will need together so you don’t have to search for them at a later date.

- Take your time – accuracy is important when completing your tax return. Give yourself plenty of time to fill it in and don’t rush.

- Go online for help – there is help and support available on GOV.UK to help you get your tax return right. But if you’re not doing it yourself, you can appoint someone to fill in and send your tax return, for example an accountant or tax adviser. If you need extra support to help your with Self Assessment you can contact a voluntary or community sector organisation who can provide you with help and advice.

- Remember the deadline – it’s 31 January 2024. Put it in your calendar or set a reminder on your phone. If you miss the deadline, you could risk facing penalties.

- Don’t forget to press ‘submit’ – if you’re filing online, don’t forget to press the ‘submit your tax return’ button. HMRC won’t receive your tax return until you press that button and if you miss the deadline – you could incur penalties.

![Prawo aborcyjne w Europie [REPORTAŻ]](https://assets.aws.londynek.net/images/jdnews/2251908/385480-202404120853-m.jpg)